Overview

Security Information includes a number of reports that give detailed information about individual securities. The available reports include the Security Summary, as well as a Tax Report and reports on Dividends and Adjustments.

Security Summary is an overview of a chosen security. It gives basic details for the security, such as industry grouping, as well as fundamentals and dividends information.

Tax Report gives a summary of information relevant to taxation.

Dividends gives detailed information about the last dividend, and a summary of previous dividends

Adjustments is a list of all adjustments to issued capital, e.g. stock splits.

Opening Security Information Reports

To view a report on a particular security, first enter that security’s symbol in the Symbol box in the toolbar:

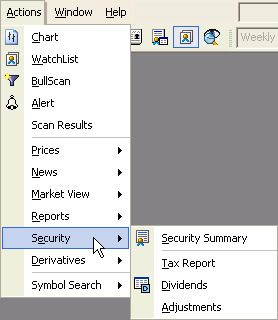

Then go to the Actions menu, choose Security, then pick the report you want:

Security Summary

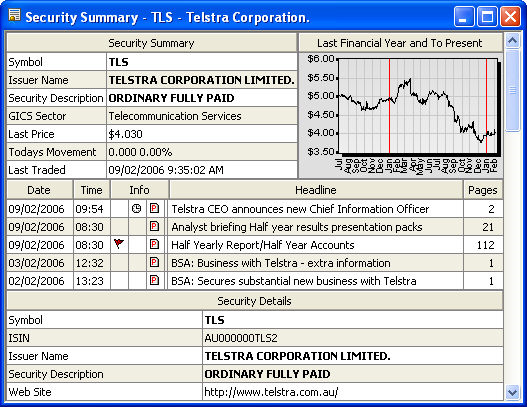

Security Summary provides an overview of the most important information about a security, including fundamental company information, dividend data, and other information such as 52 week high and low prices:

Security Summary provides an overview of the most important information about a security, including fundamental company information, dividend data, and other information such as 52 week high and low prices:

Security Summary

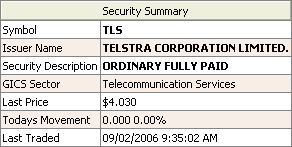

This is a brief list of the most important security details:

Last Price is the price at which the most recent trade of this security occurred.

Today’s Movement shows how far this security has moved since market open, in absolute terms and as a percentage.

Last Traded shows the date and time that the most recent trade occurred.

For explanations of other fields, see “Security Details” below.

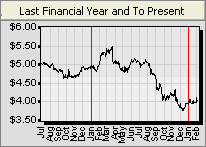

Last Financial Year and To Present

This chart depicts the security’s price since the beginning of the previous financial year:

Company News

This is a list of the last four news articles issued by the company. The Info column will contain a small flag graphic (![]()

) if the article is deemed market-sensitive, and you can click on each headline to view the article in a new window:

) if the article is deemed market-sensitive, and you can click on each headline to view the article in a new window:

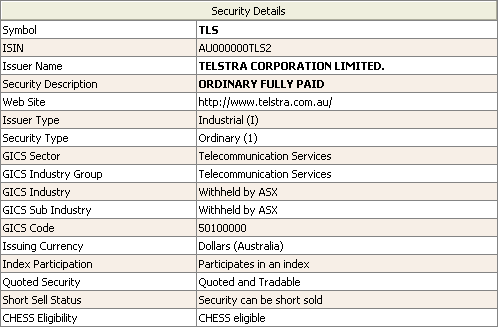

Security Details

This lists all the most important details for the security:

Symbol is the symbol used to refer to this security on the stock exchange.

ISIN is the International Securities Identification Number, which uniquely identifies this security from all security and derivative products worldwide.

Issuer Name is the name of the entity who issued this security – usually the name of the company if this security is a stock, but can be other things for other kinds of security.

Security Description describes the kind of security this is. Basic stocks are “Ordinary Fully Paid”, but Options, Warrants and other kinds of securities have other descriptions.

Web Site is the location of the company’s web site, if any. You can click on the link to visit the site.

Issuer Type is “Industrial” for normal companies, “Mining” for mining ventures, or “Other”.

Security Type is the specific type of this security. Stocks have types between 1 and 39, warrants have types between 46 and 49, and options have types from 40 to 45 and 90 to 95.

GICS Sector describes how this security is categorised in the Sector level of the Global Industry Classification Standard.

GICS Industry Group describes how this security is categorised at the Industry Group level of the Global Industry Classification Standard.

GICS Industry describes how this security is categorised at the Industry level of the Global Industry Classification Standard.

GICS Sub Industry describes how this security is categorised at the Sub Industry level of the Global Industry Classification Standard.

GICS Code is the Global Industry Classification Standard numeric code, which encodes the GICS Sector, Industry Group, Industry, and Sub-Industry categories into a single eight-digit number.

Issuing Currency describes the currency this security was originally issued in. Almost always Australian Dollars for securities on the ASX.

Index Participation is “Participates in an index” if the security’s price is used in the calculation of any index. See the “Index Participation” section later on for details of which indexes this security participates in.

Quoted Security describes whether this security can be quoted and traded. It can be “Quoted and Tradable”, “Unquoted but Tradable”, or “Unquoted and Not Tradable”.

Short Sell Status is “Security can be short sold” if the security can be short sold, otherwise the security cannot be short sold.

CHESS Eligibility describes whether the security can participate in the Clearing House Electronic Sub-registry System.

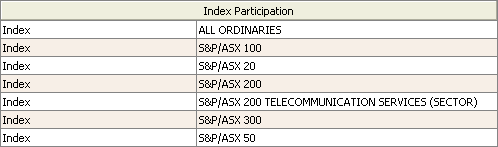

Index Participation

This is a list of all the indices that this security participates in:

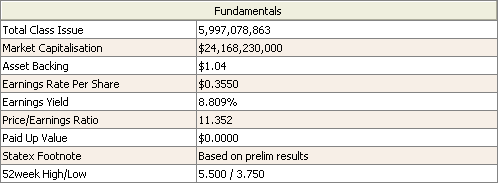

Fundamentals

Total Class Issue is the number of shares that have been issued.

Market Capitalisation represents the total worth of a company, and is calculated as the current price per share multiplied by the Total Class Issue.

Asset Backing is the total amount of the company’s assets, divided by the number of shares. The amount of assets is reported by the company annually, but Asset Backing is adjusted for any dilution that has happened since the previous asset reporting.

Earnings Rate Per Share is the company’s earnings for the past 12 months, divided by the number of shares. Company earnings are reported every 6 months, and Earnings Rate Per Share is adjusted for any dilutions that have occurred since either of the earnings reports.

Price/Earnings Ratio is the current price per share divided by the Earnings Rate Per Share.

Paid Up Value represents the amount of application money and/or calls which have been paid on any security which is only partly paid. This figure excludes any premiums.

Statex Footnote describes whether the Asset Backing, Earning Rate, Dividend Rate Per Share, and Total Annual Dividend Rate Per Share values are based on Interim or Preliminary results.

52 Week High/Low is the highest price and the lowest price over the past year.

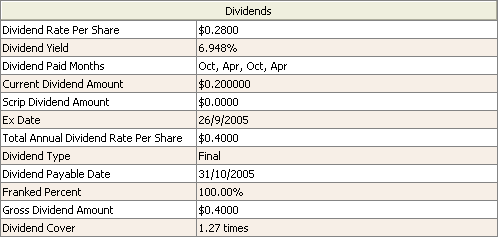

Dividends

This section lists various details about how and when dividends are paid:

Dividend Rate Per Share is the amount of dividend that has been paid for each share over the past 12 months, as reported by the company. Dividends are reported every three or six months, and any dilutions are taken into account. This does not include any special cash or scrip dividend.

Dividend Yield is the Dividend Rate Per Share divided by the price per share, expressed as a percentage.

Dividend Paid Months lists the last four months in which the company has paid dividends.

Current Dividend Amount is the cash dividend amount of the most recently announced dividend, net of withholding tax.

Scrip Dividend Amount is cash dividend amount of the most recently announced dividend (or part thereof) that was paid as share scrip.

Ex Date is the date on which share ownership is reckoned, for the purposes of the upcoming dividend. If you purchase stock in this security after the Ex Date but before the Dividend Payable Date, you will not receive the dividend. If you sell stock in this security after the Ex Date but before the Dividend Payable date, you will receive the dividend.

Total Annual Dividend Rate Per Share is the amount of dividend that has been paid for each share over the past 12 months, as reported by the company. Dividends are reported every three or six months, and any dilutions are taken into account. Unlike the Dividend Rate Per Share, this does include any special cash or scrip dividend.

Dividend Type indicates whether the dividend to be paid is an interim or final dividend.

Dividend Payable Date is the date on which the dividend is due.

Franked Percent is the portion of the dividend on which taxation has already been paid.

Gross Dividend Amount is the amount payable per security, taking into account company tax and franking for both interim and final dividends.

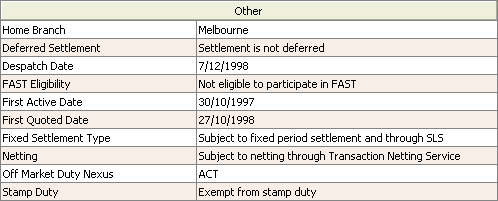

Other

This section contains various miscellaneous security details:

Home Branch describes which branch of the ASX is responsible for all listing requirements relating to the company.

Deferred Settlement indicates whether all trades will have their settlement postponed until the Despatch Date.

Despatch Date is only applicable when Deferred Settlement is in effect. It describes the date on which trades with deferred settlements will be settled.

FAST Eligibility describes whether this security can be transferred via the Flexible Accelerated Security Transfer system, the interim measure the ASX has implemented in developing a long term electronic transfer system. This field can also indicate whether a security is eligible for delivery through the FAST Interbroker Delivery Service (FIDS).

First Active Date is the date this security was first available for trading.

First Quoted Date is the date this security was first officially quoted on the ASX.

Fixed Settlement Type describes whether the security is subject to fixed period settlement and if it is possible to borrow securities through the Securities Lending Service (SLS).

Netting describes whether the security will be subject to netting through the Transaction Netting Service.

Off Market Duty Nexus is the state of Australia duty is payable to for off-market transactions (facilitated by CHESS). It must be one of New South Wales, Victoria, Queensland, South Australia, Western Australia, Tasmania, the Northern Territory or the ACT.

Stamp Duty indicates whether stamp duty applies to transactions involving this security. Stamp duty may apply in some Australian states but not others. Generally, quoted securities will be stamp-duty exempt, and unquoted securities will not.

Dividend Actions

This section summarises the last five dividends paid by this security:

When a dividend is paid out, the total dividend payout is divided by the number of shares that were in circulation on the Books Close date. For an explanation of the other fields in the table, see the “Dividends” section above.

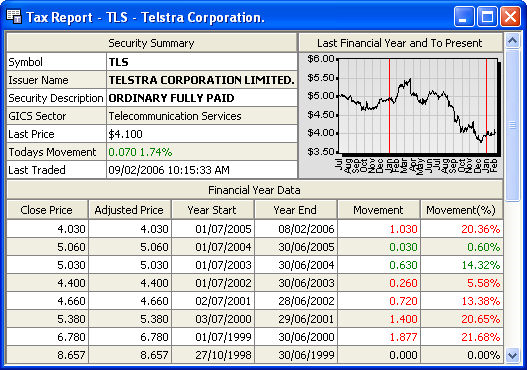

Tax Report

The Tax Report displays information relevant to taxation, and the preparation of income tax returns. It gives a summary of the movement of the security over the last financial year, as well as detailed information about the most recently paid dividend and a brief summary of the previous two.

Security Summary

See “Security Summary” under the Security Summary report above.

Last Financial Year and To Present

See “Last Financial Year and To Present” under the Security Summary report above.

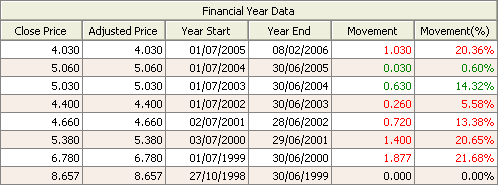

Financial Year Data

This table summarises this security’s performance over the past several financial years:

Close Price is the security’s price as of the “Year End” date.

Adjusted Price is the security’s price after taking into account any adjustments between the Year End date and now. To see the list of adjustments that might be affecting the Adjusted Price, see the Adjustments report below.

Year Start is the date that particular financial year started.

Year End is the date that particular financial year ended.

Movement is the absolute price movement in dollars between the end of the previous financial year, and the end of this particular financial year.

Movement (%) is the relative price movement between the end of the previous financial year, and the end of this particular financial year, expressed as a percentage.

Dividend Actions

See “Dividend Actions” under the Security Summary report, above.

Dividends

The Dividends report lists detailed information about the latest dividend announced, including the franked percent, the dividend type, and ex-dividend date among other pieces of information. It also includes some information on previous dividends.

The Dividends report lists detailed information about the latest dividend announced, including the franked percent, the dividend type, and ex-dividend date among other pieces of information. It also includes some information on previous dividends.

Latest Dividend Details

See “Dividends” under the Security Details report, above.

Dividend Actions

See “Dividend Actions” under the Security Details report, above.

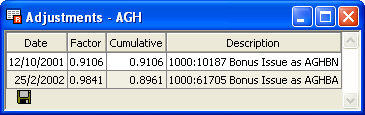

Adjustments

The Adjustments report lists any adjustments that have occurred for a particular stock. Adjustments include stock splits, bonus issues and other adjustments to issued capital.

Date is the date on which the adjustment was applied.

Factor is the amount by which the capital is adjusted. All adjusted prices prior to this date are adjusted by multiplying them by this amount.

Cumulative is the amount by which prices prior to this date are adjusted, taking into account any other adjustments that have occurred after this date.

Description is a brief summary of the reason why this adjustment was applied.