Overview

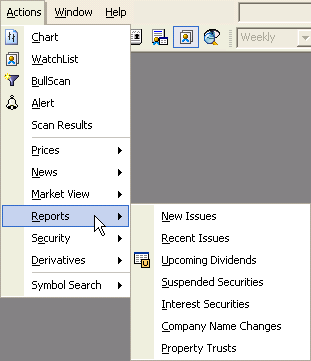

The Reports section of the BullCharts Actions menu contains various reports that do not fit into any other category:

New Issues lists all of the companies that will raise capital on the ASX in the near future.

Recent Issues lists all of the companies that have recently raised capital on the ASX.

Upcoming Dividends lists all securities for which a future ex-dividend date has been declared.

Suspended Securities lists security suspensions that have occurred today.

Interest Securities lists all Interest Rate Securities by their security type.

Company Name Changes lists all company name changes.

Property Trusts lists all property trusts listed on the ASX.

To open any report from the Reports section, go to the Actions menu, choose Report, then choose the report you want.

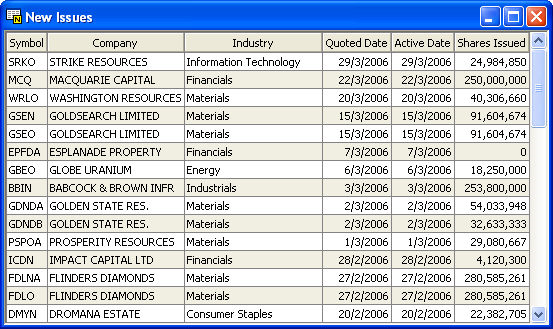

New Issues

The New Issues report shows all of the companies that will raise capital on the ASX in the near future. This includes companies that will float or existing listed companies that will raise additional capital.

Symbol is the symbol under which the security trades on the ASX.

Company is the name of the company involved.

Industry is the Global Industry Classification Standard (GICS) industry of the company in question, if known.

Quoted Date is the first day the security will actually be quoted on the exchange.

Active Date is the first day the security was added to the ASX’s list of securities.

Shares Issued is the number of shares issued.

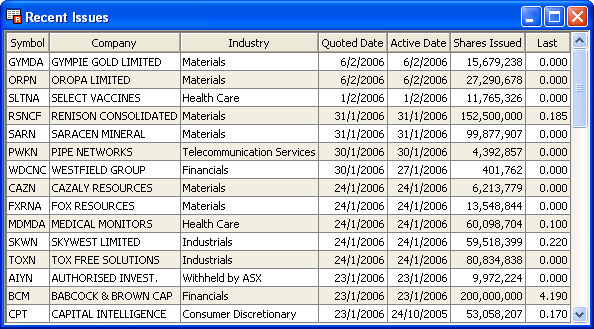

Recent Issues

The Recent Issues report shows all of the companies that have recently raised capital on the ASX. Any floats that have occurred within the past 90 days are listed.

Last is the last price for the given security.

For descriptions of other columns, see “New Issues” above.

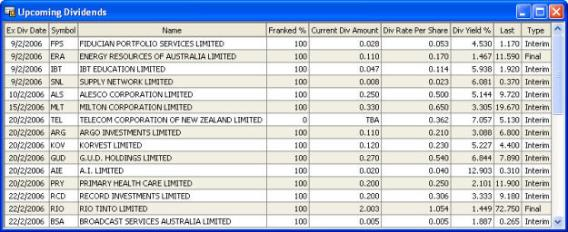

Upcoming Dividends

The upcoming dividends report shows all securities for which an ex-dividend date has been declared, as well as details on the upcoming dividend payment.

The upcoming dividends report shows all securities for which an ex-dividend date has been declared, as well as details on the upcoming dividend payment.

Ex Dividend Date is the date on which share ownership is calculated. Whoever owns the shares on that date receives the appropriate dividend. If you buy shares before the dividend payment, but after the Ex Dividend date, you won’t receive the dividend.

Franked % is the portion of the dividend on which taxation has already been paid.

Current Dividend Amount is the cash dividend amount of the most recently announced dividend, payable in dollars per security, net of withholding tax. Expressed as dollars per share.

Dividend Rate Per Share is a rolling 12 months total dividend rate per share as declared by the issuer and adjusted by dilution factors. Expressed as dollars per share.

Dividend Yield % represents the dividends received per dollar of securities held. It is calculated as (dividend rate per share) / (current share price).

Type indicates whether this is an interim or final dividend payment type.

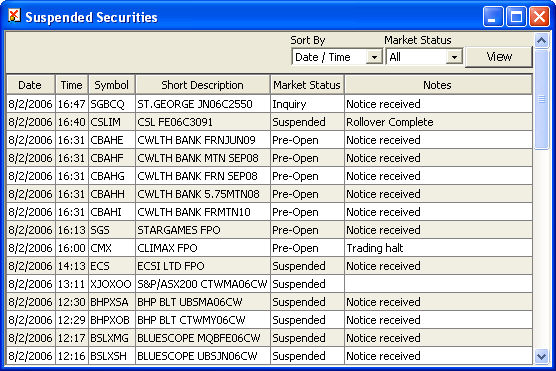

Suspended Securities

The Suspended Securities report lists security suspensions that have occurred today. You can view all security suspensions, or just suspensions of a particular type.

Date is the date on which the suspension occurred.

Time is the time on the given date when the suspension occurred.

Symbol is the symbol that was suspended from trading.

Short Description is an abbreviated description of the symbol that was suspended from trading.

Market Status describes the specific kind of suspension the security is under.

Notes describe any additional information about the suspension.

You can filter the report to only show securities with a particular status, or sort the report in various ways. Once you have adjusted the controls at the top of the page, click the View button to make the new settings take effect.

Sort By lets you choose how the report is sorted. “Date/Time” shows the newest suspensions first. “Symbol” shows the list sorted by security symbol, in alphabetical order. “Market Status” groups all the securities with the same market status together.

Market Status lets you display only securities with a particular market status. Choose “All” to display all suspended securities, or any other option to show only suspended securities with that particular market status.

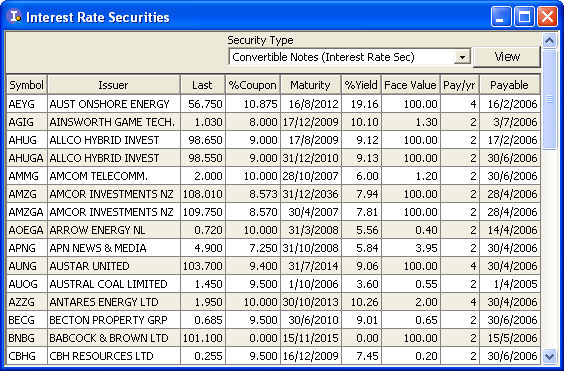

Interest Rate Securities

The Interest Rate Securities report lists all Interest Rate securities, grouped by their security type. You can display all interest rate securities, or just the securities of a particular type.

Symbol is the symbol of the security on the ASX.

Issuer is the name of the company that issued the interest rate security.

Last is the price at which the security most recently traded.

% Coupon is the interest paid per annum as a percentage of the face value.

Maturity is the date on which the principal sum (face value) will be repaid to the holder of the security.

% Yield is the interest paid per annum as a percentage of the last price.

Face Value is the principal sum originally lent to the issuer.

Pay/yr is the number of interest payments per year

Payable is the date on which the next interest payment will be made.

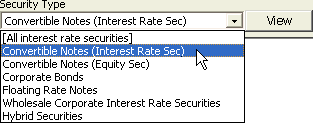

To display different kinds of interest rate security, select the type from the “Security Type” list, then click “View”.

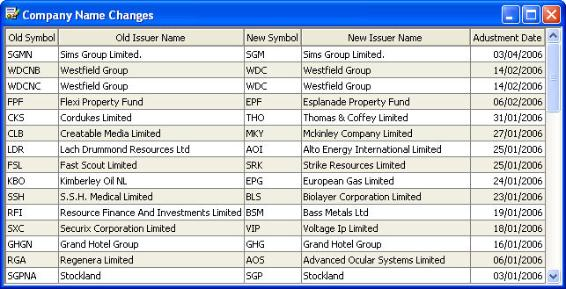

Company Name Changes

The Company Name Changes report displays recent name and symbol changes. This may occur after takeovers or reconstructions. For example, Coles Myer Limited shares traded as CMLC and CMLDA during changes to its discount card scheme. The change of these securities back to CML was displayed in this report.

Old Symbol is the symbol this security used to trade under.

Old Symbol is the symbol this security used to trade under.

New Symbol is the symbol this security now trades under.

New Issuer Name contains the issuer name of the security, in case this too has changed.

Adjustment Date is the date on which the name-change was effective.

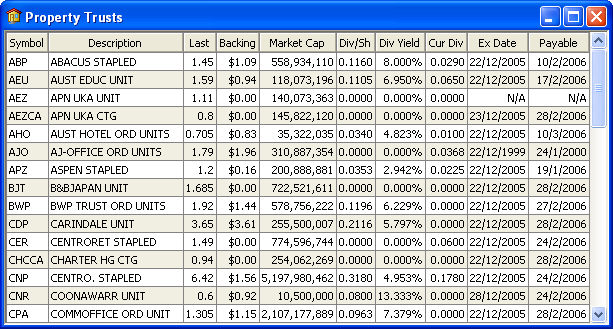

Property Trusts

The Property Trusts report lists all the property trust reports on the ASX, as well as details about each Property Trust.

Symbol is the ASX symbol of this particular security.

Description is the name of this particular security.

Last is the price at which the security most recently traded.

Backing (Asset Backing) is the total amount of the company’s assets, divided by the number of shares. The amount of assets is reported by the company annually, but Asset Backing is adjusted for any dilution that has happened since the previous asset reporting.

Market Cap (Market Capitalisation) represents the total worth of a company, and is calculated as the current price per share multiplied by the Total Class Issue.

Div/Sh (Dividend Rate Per Share) is the amount of dividend that has been paid for each share over the past 12 months, as reported by the company. Dividends are reported every three or six months, and any dilutions are taken into account. This does not include any special cash or scrip dividend.

Div Yield (Dividend Yield) is the Dividend Rate Per Share divided by the price per share, expressed as a percentage.

Cur Div (Current Dividend Amount) is the cash dividend amount of the most recently announced dividend, net of withholding tax.

Ex Date (Ex Dividend Date) is the date on which share ownership is reckoned, for the purposes of the upcoming dividend. If you purchase stock in this security after the Ex Date but before the Dividend Payable Date, you will not receive the dividend. If you sell stock in this security after the Ex Date but before the Dividend Payable date, you will receive the dividend.

Payable (Dividend Payable Date) is the date on which the dividend is due.